The Extra Point

Welcome to the Extra Point, where members of the NFL's football data and analytics team will share updates on league-wide trends in football data, interesting visualizations that showcase innovative ways to use the league's data, and provide an inside look at how the NFL uses data-driven insight to improve and monitor player and team performance.

How Defensive Schemes are Shaping the NFL's Passing Game in 2024

September 25, 2024

How the New Dynamic Kickoff Performed in the 2024 Preseason

August 27, 2024

Exploring the Physical Differences Between NBA and NFL Players

May 10, 2024

What Stats Suggest About the NFL’s New Kickoff

April 3, 2024

How Player Performance and Team Efficiency Are Affected by Each Tick on the Play Clock

January 3, 2024

How NFL Stadiums Factor in Dropped Passes

November 29, 2023

Where Have All the Points Gone?

November 16, 2023

What We Learned About Quarterback Push Sneaks During the 2022 NFL Season

April 25, 2023

How Luck Plays a Role in the Success of NFL Teams

November 10, 2022

The Evolution of Personnel Groupings and Usage: What is Versatility?

October 19, 2022

The Evolution of Personnel Groupings and Usage

October 7, 2022

Where have all of the NFL points gone?

September 27, 2022

With NFL kickers better than ever before, why are kickoffs shorter?

August 23, 2022

Using data and analytics to evaluate the 2022 club proposals on overtime in the postseason

March 30, 2022

Does Home Town Factor in Free Agency Decisions?

March 17, 2022

How NFL teams use the game clock – and what it says about late-game strategy

December 16, 2021

Which NFL teams mix up defensive coverages the most week-to-week

December 2, 2021

What it takes to evaluate the NFL’s future stars

November 11, 2021

How do NFL coaches use their timeouts?

November 10, 2021

Can Next Gen Stats Help Predict Pass Plays?

October 21, 2021

What record will be good enough to make this year’s NFL playoffs?

September 29, 2021

Assessing the Change in Draft Pick Value Across Positions

April 26, 2021

What data and analytics told us about 2021 Offseason NFL rules proposals

April 2, 2021

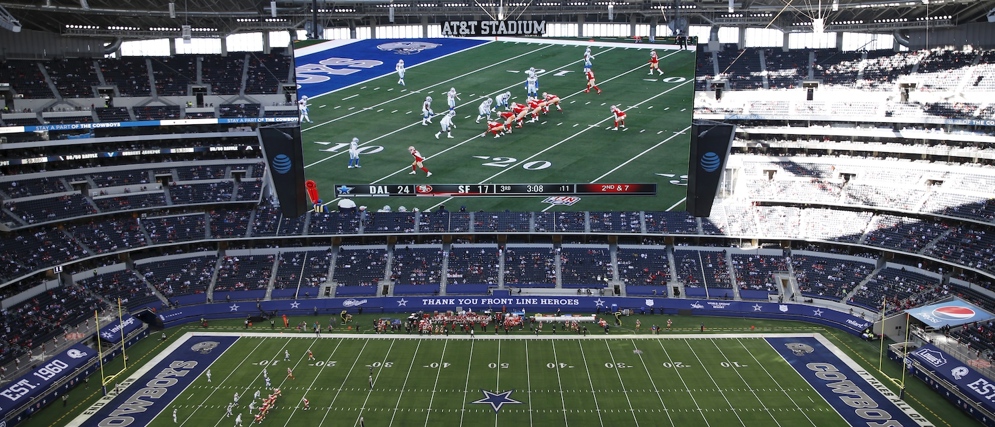

What does the NFL’s home-field advantage look like in 2020?

January 5, 2021

Analyzing Defensive Pass Interference Fouls in the NFL and NCAA

November 20, 2020

Comparing Kickers Across the League on Accuracy Between the Uprights

October 22, 2020

Evaluating Subtle Differences in NFL QB Release Points

October 1, 2020

Tom Brady — Master of the QB Sneak

September 24, 2020

Rookies on Week 1 Rosters

September 17, 2020

Field Goal Success Probabilities by Direction

July 16, 2020

Going for it on Fourth Down Becoming the New Norm for NFL Coaches

April 21, 2020

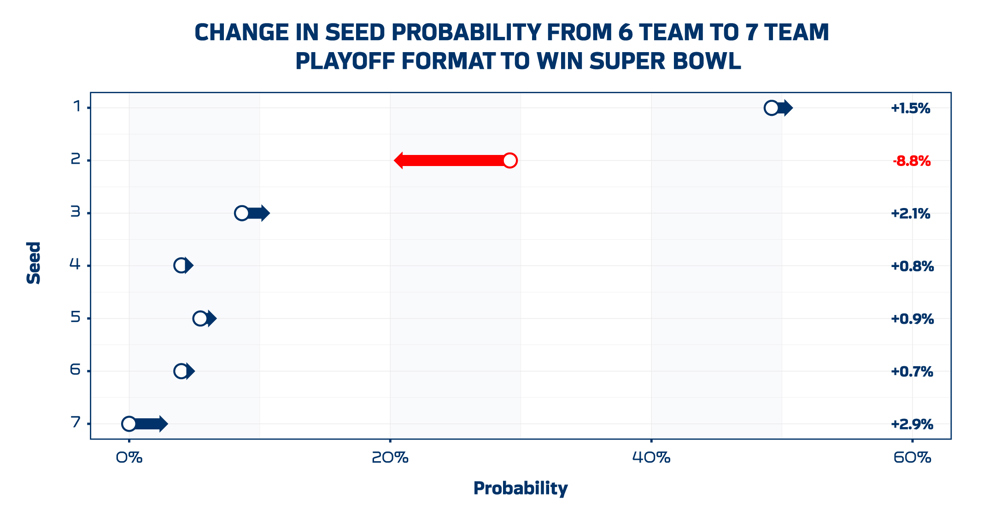

Probability models for the new 14-team playoff system

April 6, 2020

Big Data Bowl Winning Paper Leads to New Drill at the NFL Combine

March 4, 2020

2020 Big Data Bowl Recap

February 27, 2020

What the Top Predictions Looked Like in the NFL's Big Data Bowl

January 27, 2020

Why Fourth-and-15 from the 25? Insight into the NFL’s experiment with an onside-kick alternative

January 24, 2020

Punters in 2019 Were Performing Better Than Ever

January 17, 2020

More Girls are Playing Tackle Football

January 9, 2020

The Biggest NFL Comebacks of the Last Decade

December 31, 2019

When are teams being more aggressive on fourth down?

December 24, 2019

Teams Taking More Time Off Play Clock in 10-minute OTs

December 19, 2019

Win Probability Models for Every NFL Team in 2019

December 11, 2019

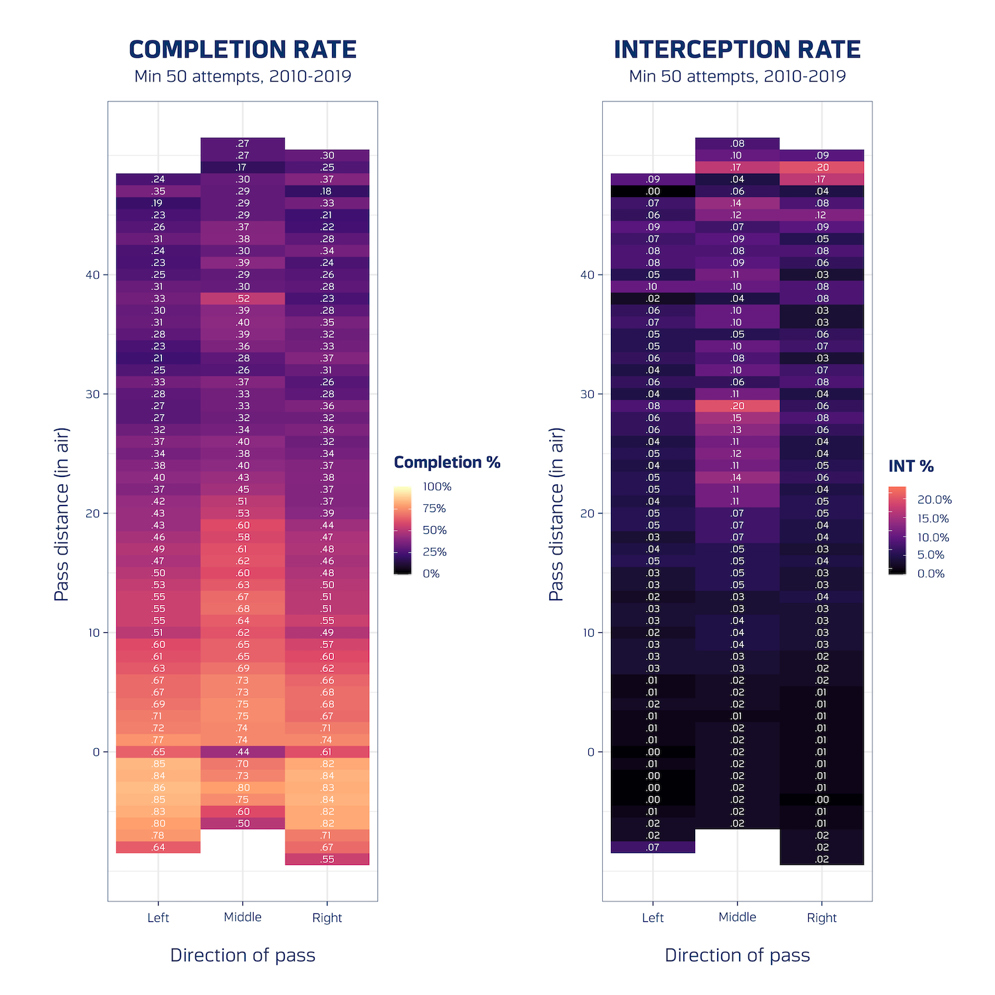

Where’s the best spot on the field to complete passes… and not get picked off?

December 5, 2019

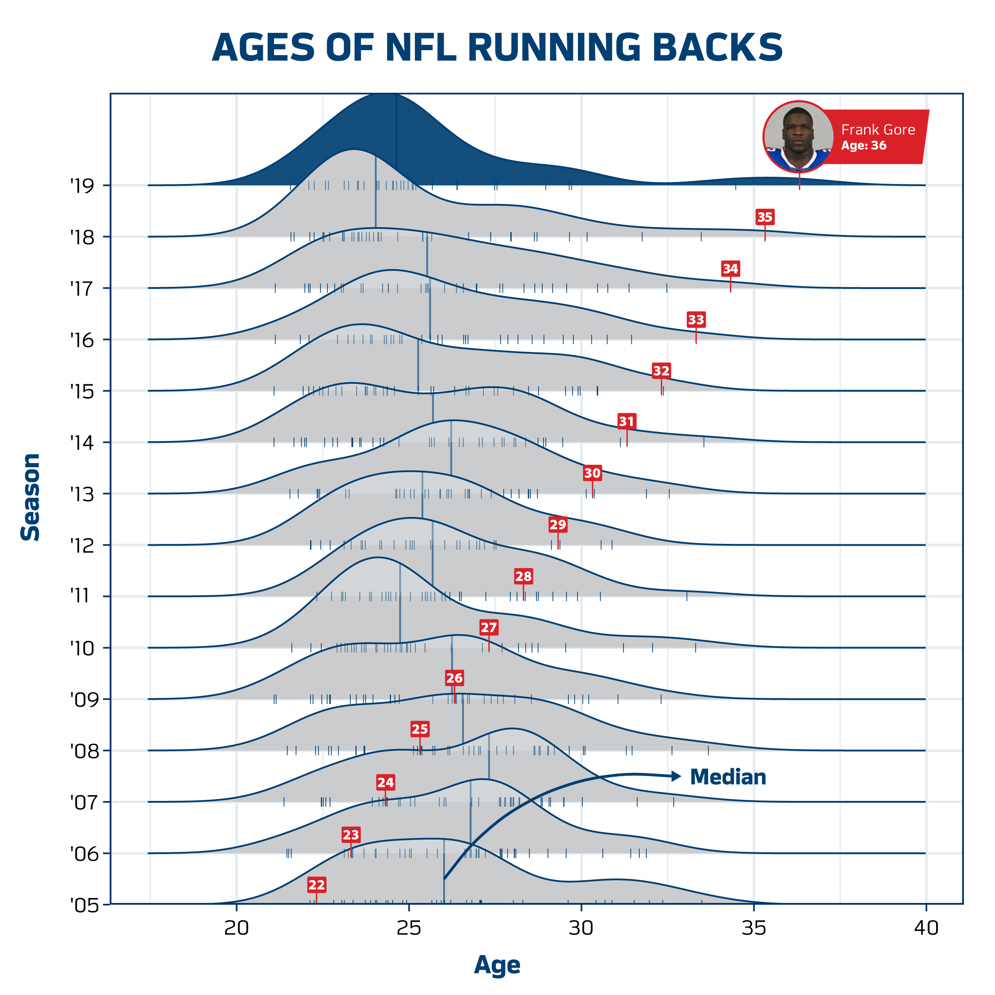

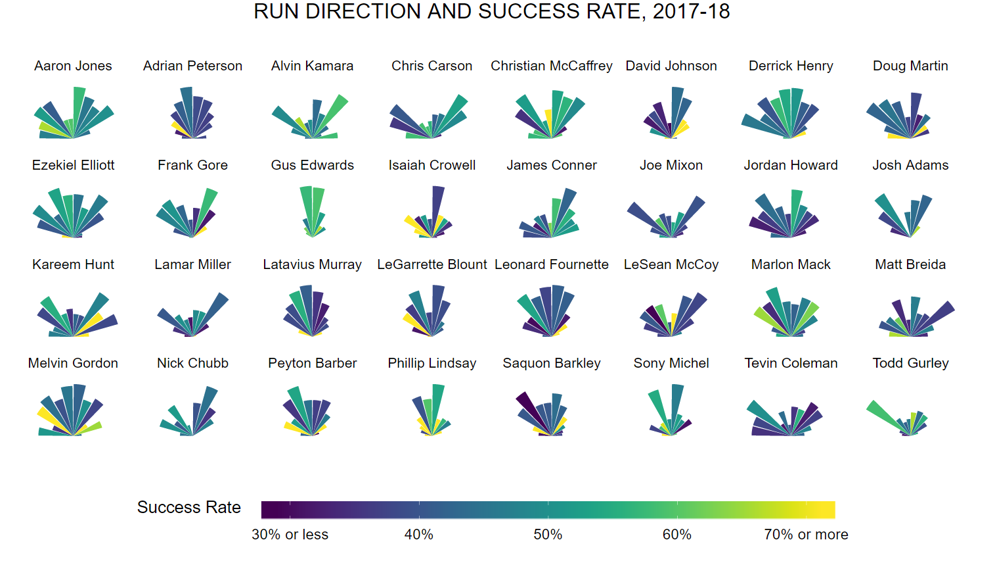

Frank Gore Keeps on Running

November 27, 2019

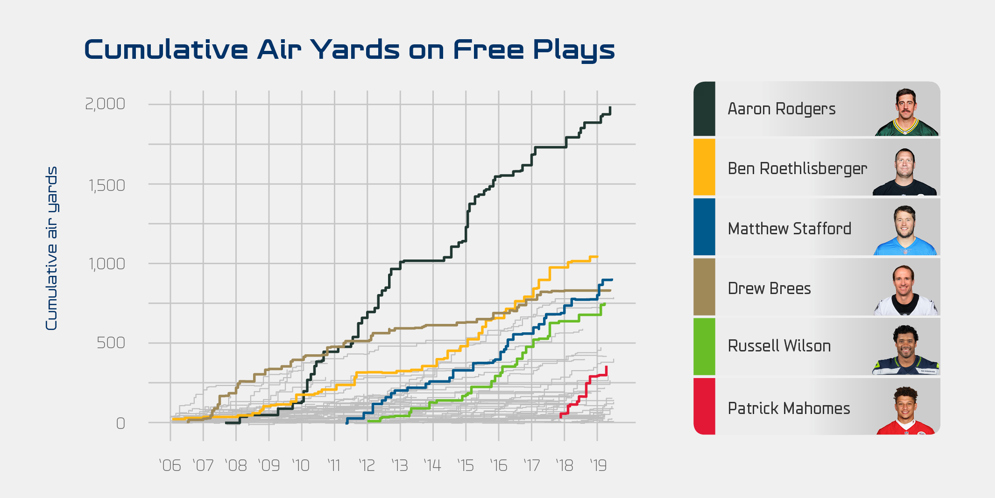

Aaron Rodgers Takes Advantage of Free Plays Better Than Anyone

November 21, 2019

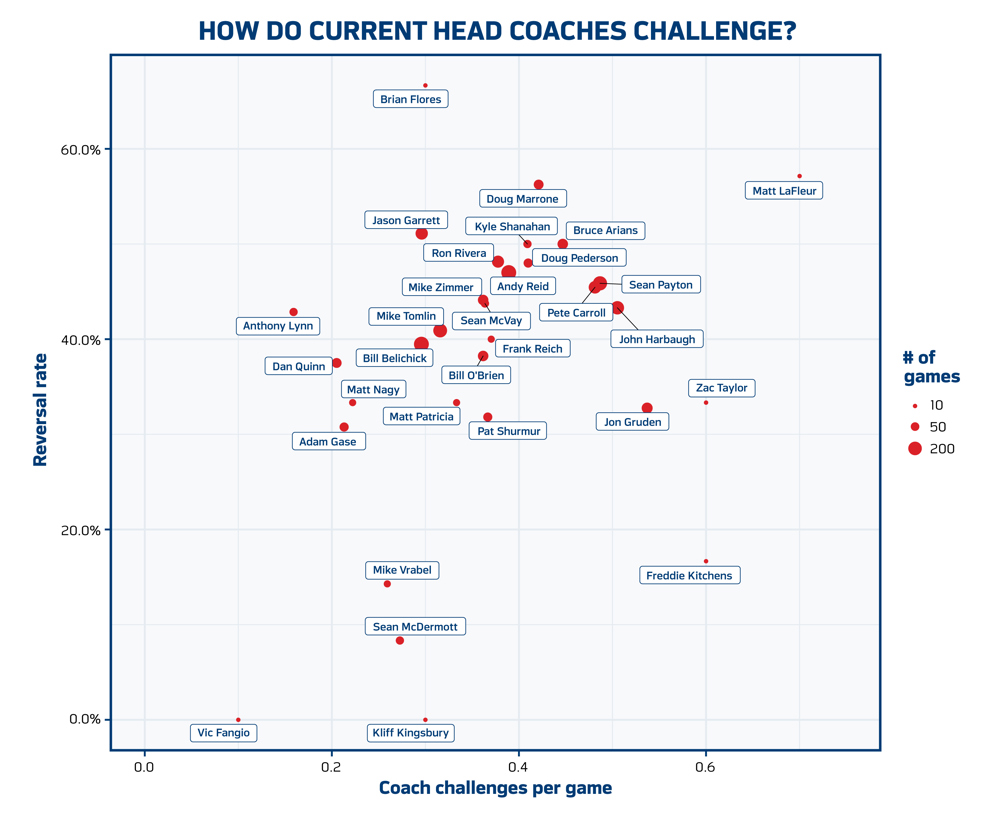

How Do NFL Coaches Use Their Challenges?

November 14, 2019

Visualizing the Special Teams Gunner

October 29, 2019

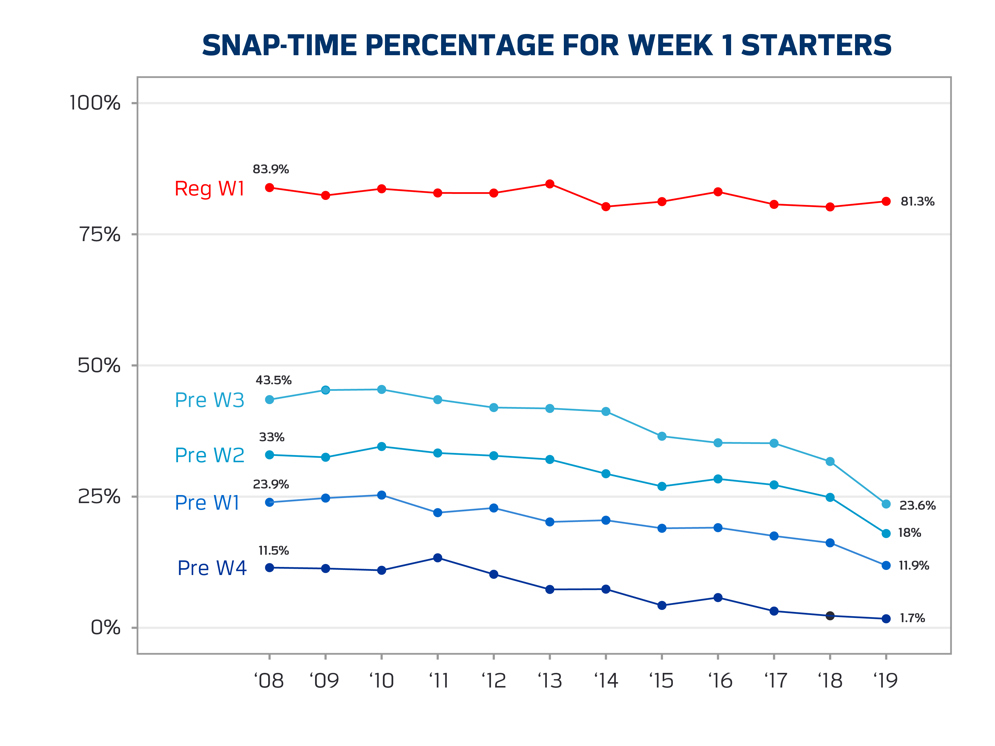

What Numbers Tell Us About Preseason Play Time

October 23, 2019

Where Do Ball Carriers Tend to Move?

October 15, 2019

A Conversation with Two Big Data Bowl Finalists

October 10, 2019

What Can Player Tracking Data Tell Us About the Onside Kick?

October 2, 2019

Q&A with 2019 Big Data Bowl College Winners

September 25, 2019

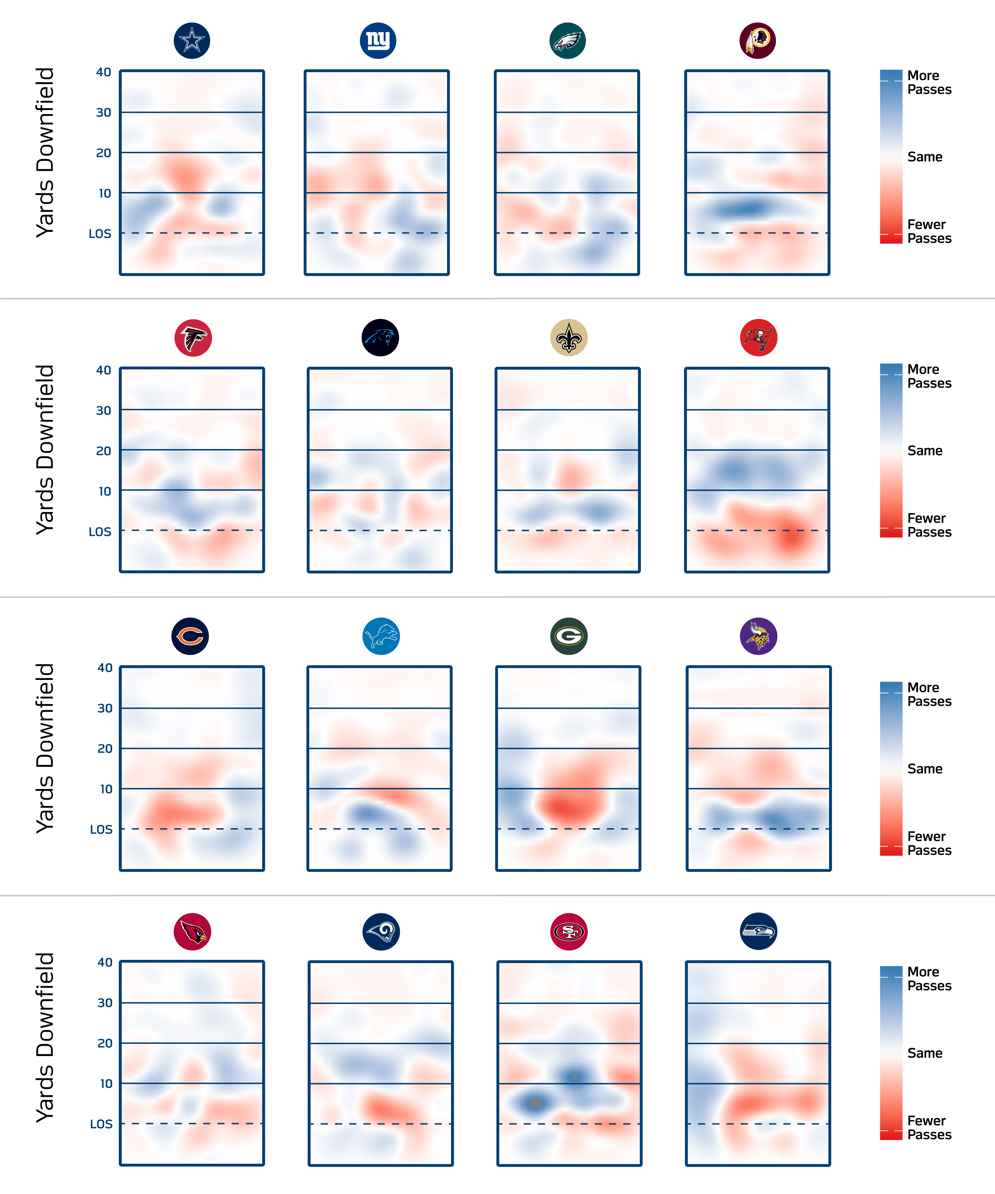

Where Your Favorite Team Likes to Pass the Ball

September 23, 2019

Using Data and Analytics to Identify High-Impact Fouls

September 23, 2019

How Defensive Schemes are Shaping the NFL's Passing Game in 2024

September 25, 2024

In the mid-2010s, the NFL saw a surge in passing offense resulting in the running game taking a back seat. The 2015 and 2016 seasons featured more than 480 passing yards per game — the highest passing seasons in league history. Those same seasons saw fewer than 220 rushing yards per game — the lowest since 1999.

Passing yardage per game was relatively steady through 2020, but the start of the 2024 season is shaping up to continue a five-year decline. In Weeks 1-3 across recent seasons, passing yards per game have dropped from 496 in 2020 to 491 in 2021, 462 in 2022, 444 in 2023, and just 403 thus far in 2024.

If this trend continues, 2024 will see the fewest passing yards per game since 1993.

What explains the trend?

Several factors are at play, but one significant change is the increased use of multiple safeties in defensive schemes. The examples below show that defenses have embraced formations like Cover 2, Cover 4, and Cover 6. According to Next Gen Stats, the percentage of two-high safety looks on passing attempts has jumped from 44% in 2019 to 63% in 2024.

Beyond pre-snap categorizations, Next Gen Stats player location data offers deeper insights. The plot below visualizes where all defensive players were positioned at the snap during Weeks 1-3 of the 2024 season, compared to the same period in 2019. The color intensity shows changes in player positioning probabilities — red indicates an increased presence of defenders, and blue represents a reduced presence.

The 2024 season reveals a clear shift, particularly with more two-high safety looks. In 2019, defensive backs were more likely to play press on the outside with a single high safety (middle field closed) whereas in 2024, the pattern resembles a “red crab,” with linebackers or hybrid defensive backs positioned 4-6 yards off the line and two split safeties (middle field open) 10-15 yards deep. Of note, this does not account for post-snap rotations, but this chart reproduced for one- and two-seconds post-snap does not look materially different.

These defensive adjustments may also explain other early trends in 2024. For instance, average air yards per pass attempt have dropped to 7.7 yards — the lowest in over a decade and nearly a full yard fewer than in 2019. Deep pass attempts — throws 20+ yards downfield — have decreased from 10.2 per game in 2019 to 7.7 per game in 2024.

Defenses are evolving to counter the air attack and the impact is clear — we’re seeing fewer passing yards, shorter throws, and fewer deep passes through the first three weeks.

How the New Dynamic Kickoff Performed in the 2024 Preseason

August 27, 2024

After much anticipation, the NFL’s new Dynamic Kickoff debuted this preseason. Fans have experienced fresh strategy and excitement with the play’s designated landing zone, updated player alignment, and plays that begin only after the ball is caught or hits the ground.

Last spring, our analytics team analyzed XFL data to predict outcomes. After watching 49 games and 420 new kickoffs this preseason, here’s what we discovered:

- More Kickoff Returns: Nearly 300 kickoffs were returned this preseason, resulting in a 70.5% return rate — the highest since 2014. For comparison, last year’s return rate was 54.8%. This increase contributed to more big plays, with 18 returns over 40 yards, also the most since 2014.

- Better Drive Start: On all kickoff plays, the average drive start for the return team was the 28.8 yard-line, a 4.6-yard increase from 2023 and a 4.1-yard increase from 2022. On kickoffs that were returned, the average drive start was the 28.0 yard-line.

- Kickers as Tacklers: Kickers registered 11.5 tackles plus assists according to the official NFL game stats report, which is up from 4 in 2023 and 6 in 2022. Most of that increase was driven by extra returns — more returns lead to more tackle plays. Kickers were involved in 3.6 tackles per 100 returns in 2024 versus 3.1 in 2023 and 2.9 in 2022.

Finally, here’s a strategic tip: kicking teams should aim to place the ball at the back of the landing zone.

Using data on where the ball lands, here’s a chart showing the resulting field position by kickoff land location.

Kicks landing in the back of the landing zone — between the 1- and 5-yard lines — resulted in an average drive start from the 27.4-yard line. Kicks to the middle of the landing zone — between the 6- and 10-yard lines — led to an average drive start around the 30-yard line. Therefore, kicking deeper into the landing zone was, on average, a few yards better for the kicking team this past preseason.

Exploring the Physical Differences Between NBA and NFL Players

May 10, 2024

Former NBA player, Austin Rivers, made headlines when he said that 30 NBA athletes might seamlessly transition to the gridiron, but NFL stars could not make a similar move to the NBA.

Our Football Analytics team attempted to define the athleticism and skill sets needed in each sport; since those metrics are difficult to capture, the team turned to readily available and easy-to-contrast data — height and weight.

Below is a chart showing the size of everyone who played in the 2023–24 regular season of each league. NFL players are represented by blue dots, while NBA players appear as red dots.

On average, NFL players tend to weigh 29 pounds more than their NBA counterparts. Yet an NBA player is, on average, four inches taller than an NFL player, with 447 NFL players (21%) listed under 6’0” compared to only seven NBA players (1%).

But how many NFL and NBA players have the same height and weight? There’s overlap among those standing between 6’0” and 6’6” and weighing between 200–250 pounds.

Using a statistical classification model, we identified 57 NFL players with height and weight profiles closer to NBA players. There were only 18 NBA players with similar profiles to NFL players.

The NBA’s Isaiah Thomas, Kyle Lowry, Fred VanVleet, Marcus Smart, Luguentz Dort, and Donovan Mitchell have physical builds more common among NFL players. NFL players Tariq Woolen, Trevor Lawrence, Justin Herbert, Jameson Williams, Christian Watson, and DeVonta Smith have height and weight more common among NBA players.

NBA players would be hard-pressed to make the switch to one position group: offensive linemen. None of the 582 NBA players in 2023–24 weighed 300 pounds or more, a weight class occupied by 92% of offensive linemen. Meanwhile, 19 of the 244 NFL wide receivers in 2023–24 share the height and weight characteristics of NBA players.

Contributed by Tom Bliss and Michael Lopez

What Stats Suggest About the NFL’s New Kickoff

April 3, 2024

The NFL kickoff has evolved in several ways over the past 30 years. Ahead of the 2024 season, NFL clubs have approved major changes to the kickoff rule to increase the return rate and reduce player speed and high-speed collisions.

Here’s a video explaining the new format:

The NFL Football Operations data and analytics team has spent the offseason analyzing the potential impact of the rule. Some of the analysis was pulled from XFL data and its similar kickoff format.

Here are a few things to expect during the 2024 season:

- More returns. With kickers encouraged to kick the ball into the landing zone — between the goal line and 20-yard line — special teams coaches estimate that between 50–60% of kickoffs will be returned. This compares to a record-low 22% of kickoffs that were returned during the 2023 season.

- Better field position for the return team. The average XFL field position on returns was the 29.1-yard line, varying based on several factors outlined in the chart below. As a result, NFL drives are expected to start closer to the 30-yard line, out from the 25-yard line under the old rule.

- Uncertainty. In 2023, 88% of drives after kickoffs started between the 21–30-yard lines. In the new format, variability is expected on both sides of that interval. During the 2023 XFL season, 30% of drives started on or beyond the 31-yard line, and 17% of drives started inside the 20-yard line.

A new strategy is also expected to infiltrate the play — where the kicker should aim his kick.

This chart outlines the field position for the return team on kickoff returns. The locations where kickoffs land are categorized into five groups:

- 16–20-yard line

- 11–15-yard line

- 6–10-yard line

- 1–5-yard line

- Kicks returned that landed in the end zone

The text on the right gives the average and median field position, along with the percent of time that starting field position is inside the 30-yard line within each category. The 30-yard line is a critical marker for both teams, since that’s where the ball would be placed on kicks that land in the end zone.

The deeper the ball is kicked, the worse field position for the receiving team. Kickoffs returned after landing in the end zone had a median starting field position at the 23-yard line. Returns originating further out from the end zone provided better starting field positions. For example, kicks landing between the 16–20-yard lines had a median starting field position at the 29-yard line.

In most yard-line groups, the average field position is greater than the median. However, this average is skewed by some long kickoff returns. Kickoffs landing between the 1–5-yard lines had a median starting field position at the 26-yard line, but six kickoff returns past midfield skewed the average, bumping it out to the 28.7-yard line.

Why does this matter? When the return team is debating whether to return a kick landing near its end zone, the choice might be impacted by average starting field position, which is more friendly to the return team than the median field position.

Finally, kickers can’t kick the ball too deep. The resulting touchback for kicks in the end zone is the 30-yard line, versus the 25-yard line in 2023.

With the incentives of the new kickoff and this data, kickers are expected to aim their kicks towards the back of the landing zone and force a return. Ideally for the kicking team, this results in tackling the returner short of the 30-yard line.

How Player Performance and Team Efficiency Are Affected by Each Tick on the Play Clock

January 3, 2024

During the NFL’s Week 15 game between the Pittsburgh Steelers and Indianapolis Colts, Steelers linebacker T.J. Watt timed his pass rush perfectly to sack Colts QB Gardner Minshew.

In the clip below, Watt is nearly across the line of scrimmage before anyone else has moved.

One potential reason for Watt’s anticipation? The play clock, which ticked down to only one second at the time of the snap. With such little time left, Watt seemed to time the snap and gain an edge on the Colts’ offensive line.

This skill is not unique to Watt – using Next Gen Stats tracking data, defensive ends typically reach speeds that are 10% faster with one second left (16 MPH) on the play clock, relative to 10 seconds left (14 MPH).

More importantly, that impact of the play clock extends to the entire offensive side of the ball.

The graph below shows the expected points added (EPA) per play from 2016-23 by quarter, play type (run or pass), and time remaining on the play clock. The size of the dots represents the relative sample size for a given play clock snap time.

In the first quarter, there is a dramatic drop in EPA as the play clock ticks for passing plays – roughly a 0.015 EPA per play decrease for each second on the play clock. This trend represents an overall delta of approximately 0.2 EPA per play from 15 seconds on the play clock to one second. For reference, a difference of 0.2 EPA per play is similar to the difference between the second-highest EPA per pass team of 2023 (Dallas Cowboys) and the 19th-highest EPA per pass team of the 2023 season (Indianapolis Colts).

A drop in offensive efficiency also exists in the second (-0.009 EPA per play clock second) and third quarters (-0.008 EPA per play clock second). By the fourth quarter, however, when play clock snap time typically ties to score and time remaining, the relationship is not as strong (-0.004 EPA per play clock second).

There is no noticeable link between running play performance and play clock time.

Outside of the ability of defensive players to anticipate snap counts late in the play clock, there are a few other explanations for the drop in offensive performance. For example, quarterbacks less prepared to face specific defensive looks may take longer on the play clock as they change their protection or play call. In the first quarter, offenses typically “script” plays – anything off script may result in more time on the play clock and worsen performance.

This decline in performance appears to exist for most teams. Since 2016, for 71% of team seasons (182 of 256), the average EPA on passes were lower on plays snapped with five or less seconds on the play clock, relative to those snapped with 10 or more seconds. This season, the Seattle Seahawks have a 0.06 EPA per play when the ball is snapped with 10 or more seconds, but -0.39 EPA per play when the ball is snapped with five or less seconds.

How NFL Stadiums Factor in Dropped Passes

November 29, 2023

After Kansas City Chiefs wide receiver Marquez Valdes-Scantling dropped a possible game-changing touchdown pass at home against the Philadelphia Eagles on Monday Night Football, Miami Dolphins wide receiver (and ex-Chief) Tyreek Hill tweeted the following:

Hill knows about catching balls in Kansas City as well as anyone, as he has the second-most targets at Arrowhead Stadium from 2016 to present (342 total).

So, does he have a point about the lights?

Using PFF data, we looked at the rates of dropped passes in each team’s home stadium during Week 12 games from 2016-23, filtering for current stadiums only and splitting by start time to account for potential differences during the day and night hours.

In the chart below, each dot represents a drop rate — the percent of catchable balls that are labeled as drops — using stadium/start times with at least 150 catchable pass attempts since 2016. The dotted vertical line in the middle reflects the league average drop rate of 6.7%.

Kansas City’s home stadium (currently GEHA Field at Arrowhead Stadium) is the only one (out of 30) that boasts a statistically higher drop rate at night than during other game times. The 10.3% of catchable passes dropped in Kansas City at night is the highest of any stadium/start time combination. And the drop rates in Kansas City at 1 p.m. (6.5%) and 4 p.m. (6.7%) are in line with the league average.

The high drop rate at Arrowhead is also exacerbated for Hill, who dropped 13 of 89 (14.6%) catchable balls at night, far above his rates at 1 p.m. (1.7%) and 4 p.m. (4.1%). Away from Kansas City, Hill has only dropped four of 102 catchable balls at night (3.9%).

Only one other stadium showed a significantly different drop rate by start time. Baltimore’s M&T Bank Stadium had a significantly lower drop rate at night (4.5%, compared to 7.1% at 1 p.m. and 9.3% at 4 p.m.).

As an additional comparison, the 10 stadiums with the highest drop rates are all outdoors, and nine of the 10 with the lowest drop rates are domes or warm-weather teams, excluding Cincinnati. What’s more, the drop rate at the outdoor MetLife Stadium in New Jersey (8.1%) is roughly 1.8 times higher than Minnesota’s domed U.S. Bank Stadium (4.6%).

Contributed by: Tom Bliss and Michael Lopez

Where Have All the Points Gone?

November 16, 2023

Through Week 10 of the 2023 NFL season, scoring has been at its lowest in over a decade with several dominant defenses and few high-scoring offenses.

What has changed this season? Here is a mid-year look at the 2023 NFL season

Scoring

The following table shows key scoring-related metrics through Week 10. The color of each cell corresponds to the relative rank (since 2003) of the 2023 season.

While first-half scoring has been close to the median across the last 20 seasons, third- and fourth-quarter scoring are closer to the bottom. For example, 12.0 points scored per fourth quarter is the lowest in the league since 2005. Drives per game are also low, meaning teams have fewer opportunities to convert a possession into a score.

While 3rd/4th-and-short success is in line with previous years, 3rd/4th-and-medium/long success have been historically low this season. The 2023 season is the first in 20+ years of play where the 3rd/4th-and-long (seven yards or more) conversion rate was less than 40%.

Quarterback Play

The second table focuses on quarterback play.

This season has featured 48 starting QBs, the sixth-most through Week 10. Sacks, scrambles, and average time to throw are all high, meaning QBs are holding on to the ball longer and either taking a sack or leaving the pocket.

While pass attempts over 20 yards have decreased to only 8.8 per game, passes that are behind the line of scrimmage have increased to 16.1 per game. With fewer deep passes, interceptions per game have decreased to 0.8 per game.

Other Metrics of Interest:

- NFL punting is the strongest it has been since at least 2003 (likely in NFL history) with 41.8 net yards per punt.

- Defensive pre-snap fouls per game is third lowest in the last 20 years with 1.6 per game.

- Onside kick recovery rate remains low (5.6%): This recovery rate follows in line with recent seasons under the 2018 kickoff alignment (13.5% recovery rate before 2018).

Overall, the average 2023 NFL game has been more conservative than previous years with fewer deep pass attempts and fewer frequent, longer drives.

Will the second half of the 2023 NFL season look different?

Contributed by: Tom Bliss and Michael Lopez

What We Learned About Quarterback Push Sneaks During the 2022 NFL Season

April 25, 2023

From 2017 through the 2022 NFL regular season, the rate of all quarterback sneaks increased by nearly three times (0.39 per game to 1.08). During the 2022 season, there was a dramatic uptick in “push sneaks” where players lined up behind/offset to the QB in a sneak formation and immediately pushed the back of the QB (indirect pushes are less clear). This contrasts with the “traditional” sneak, where the QB is not intentionally pushed from behind.

To better understand and define the impact of push sneaks, the NFL reviewed sneaks of all kinds using film from the 2017 through 2022 seasons. For a play to be considered a sneak, the QB must receive an under-center snap and immediately move forward once possession has been established.

Here is the information collected for each play:

Here is the information collected for each play:

- What kind of sneak was it?

- Traditional: QB was not intentionally assisted by a player on the offense

- Direct Push: QB was intentionally, immediately, and directly assisted by a player on the offense (non-OL)

- Indirect Push: QB was likely intentionally but not immediately assisted by a player on the offense (non-OL)

- Who performed the push?

- Was the play successful? Defined by gaining one or more yards from the team’s own goal line, gaining 40% of needed yards on first down, 60% of needed yards on second down or 100% of needed yards on third or fourth down.

Traditional

Figure 1: Two examples of traditional sneaks.

Push Sneak

Figure 2: Two examples of push sneaks. LEFT: Derek Carr (QB #4) is pushed by Alec Ingold (#45), RIGHT: Jalen Hurts (QB #1) is pushed by Miles Sanders (RB #26) and A.J. Brown (WR #11).

Philadelphia Eagles at Arizona Cardinals | 2022 Regular Season - Week 5

Jalen Hurts (QB #1) is pushed by Miles Sanders (RB #26) from a variation of the Maryland I Formation.

Tampa Bay Buccaneers at Miami Dolphins | 2017 Regular Season - Week 11

Ryan Fitzpatrick (QB #14) is pushed by Doug Martin (RB #22), Chris Godwin (WR #12), and Cameron Brate (TE #84) from a variation on “victory formation”.

Table 1 provides a summary comparing the success rate of push sneaks versus traditional sneaks, based on the line of scrimmage.

Overall, success rates were similar for both push and traditional sneaks, with push sneaks slightly more effective from near the offense’s own goal line. However, success rates are not consistent for all with high push sneak rate teams (Buffalo Bills, Cleveland Browns, Dallas Cowboys, Indianapolis Colts, and Philadelphia Eagles) ahead of the pack in terms of efficiency on both traditional and push sneaks.

In terms of the players doing the pushing, approximately 45% of all pushers were running backs, 25% tight ends, 15% wide receivers and 11% fullbacks (up to three players on any given play can be considered a pusher). Miles Sanders was the leader with 18 “push assists” over the study period.

The majority of sneaks not from the offense’s own goal line occurred on third/fourth down or the opponent’s goal line. Additionally, on plays where the QB jumps over the line of scrimmage (in all areas of the field), the success rate is 79%.

In summary, the NFL reviewed video and Next Gen Stats of thousands of plays to check for the presence and type of QB sneaks. While push sneaks have increased in frequency over the last two years, they do not appear to be more effective than traditional sneaks at gaining the offense a first down.

Note: Due to the amount of manual film review required and no clear definition for a push sneak, the numbers reported might vary slightly from those presented elsewhere publicly, such as those in Kalyn Kahler’s series of articles on The Athletic.

Contributed by: Juliana Bushnell, Ananya Singh, Andrew Patton, and Michael Lopez

How Luck Plays a Role in the Success of NFL Teams

November 10, 2022

At the end of last season’s Baltimore Ravens at Detroit Lions Week 3 game, Ravens kicker Justin Tucker nailed a 66-yard game winning field goal as time expired. Had Tucker missed – which according to the Next Gen Stats team, he had a 90% chance of doing – the game would have ended with a Lions victory. So, Tucker’s near-impossible kick cost the Lions 90% in expected win probability (or 0.90 wins).

Although NFL game outcomes are far from random, teams still get lucky. We identified four key scenarios where teams benefit from actions in a game that are almost entirely derived from opponent performance or lucky bounces.

- Dropped Interception (dropped by opponent): When an opponent drops an interception, you get lucky. We assume that the intercepting team keeps possession at the spot of the drop.

- Dropped Pass (dropped by opponent): When an opponent drops a pass, you get lucky. We assume the offense would gain yards after catch using the Next Gen Stats Expected YAC model.

- Field Goals and Extra Points (attempted by opponent): When an opponent misses a kick, you get lucky, and when your opponent makes a kick, you get unlucky. Field goal make probabilities are based on the Next Gen Stats Field Goal Probability model.

- Fumble Recoveries (by either team): When a team recovers a fumble, there’s a chance the luck of the bounce was involved. Fumble recovery probabilities are based on observed recovery percentages by when the fumble occurred (i.e., after a catch, during a rush, fumbled snap, muffed punt).

The chart below shows wins added by various categories of “luck” in Weeks 1-9 of the 2022 season. These values are measured by calculating the win probability of the observed outcome and subtracting the expected win probability based on the likelihood of each luck outcome. Win probability is calculated using the time remaining, point differential, down, distance, yard line and timeouts remaining. Expected wins added is calculated by summing the win probability of each outcome weighted by the chance of the outcome occurring. Thus, an opponent missing a game-winning field goal with a 90% chance of being good is measured as considerably more lucky (+0.90 wins) than an opponent missing a game-winning field goal that had a 10% chance of being good (+0.10 wins).

According to our analysis, the Pittsburgh Steelers have the highest total statistical luck in Weeks 1-9 of the 2022 season. This includes benefitting from one of the luckiest opponent field-goal outcomes of the season when the Cincinnati Bengals missed a game-winning 29-yard field goal in overtime in Week 1 (+0.58 wins), and the luckiest dropped pass of 2022 when the Bengals dropped a game-winning touchdown near the end of regulation (+0.36 wins).

On the other hand, the Carolina Panthers have benefited the least in 2022. The Panthers lost to the Cleveland Browns in Week 1 on a 58-yard game-winning field goal (-0.61 wins), and to the New York Giants in Week 2 on two field goals over 50 yards in the fourth quarter (-0.27 total wins).

It’s important to note that our estimates of luck appear to be, indeed, luck. For example, when comparing the split-season correlations of luck (i.e., a team’s luck in Weeks 1-9 versus Weeks 10-17), each of our four components of luck are uncorrelated. So, there’s nothing to suggest that over the course of the rest of the season, the Steelers will remain lucky while the Panthers remain unlucky.

Here are the highest wins added outcomes of 2022:

- Dropped Interception (dropped by opponent): Week 1 Indianapolis Colts at the Houston Texans – Texans dropped an interception up by 7 with 1:05 left on the clock (+0.31 wins).

- Dropped Pass (dropped by opponent): Week 1 Pittsburgh Steelers at the Cincinnati Bengals – Bengals dropped a pass in the endzone down 6 with :09 seconds left on the clock (+0.36 wins).

- Field Goals and Extra Points (attempted by opponent): Week 1 New York Giants at the Tennessee Titans – Titans missed a 47-yard field goal down 1 with :04 seconds remaining (+0.66 wins).

- Fumble Recoveries (by either team): Week 2 Arizona Cardinals at the Las Vegas Raiders – Raiders fumble recovered by the Cardinals and returned for a game-winning touchdown in overtime (+0.28 wins).

The Evolution of Personnel Groupings and Usage: What is Versatility?

October 19, 2022

During the 2022 NFL season, more than 60% of offensive snaps have been played with 1 RB, 1 TE, and 3 WR (“11” personnel) and nearly 65% of defensive snaps with 5 DBs (nickel). However, as we hinted in a prior article, the personnel complexities of these groupings go beyond simply counting the number of players with a certain position listed in the roster.

To better understand the evolution of roster positions, we turn to Next Gen Stats (NGS). NGS automatically assigns a play-level position to each player based on where they line up on the field, regardless of their listed roster position. For example, if a punter is lined up as a defensive end with a hand on the ground, they have a position of “edge” assigned to them for that specific play. Offense and defense have six and nine positional category assignments respectively, with each player assigned to exactly one category on a given play.

To assess how well distributed the player’s snaps are within the possible positional alignment, we calculate (using the Gini coefficient similar to Krishna Narsu’s NBA versatility), a versatility score with a higher value indicating more positional alignment versatility and a lower value less positional alignment versatility. The two tables below show the top five most positionally versatile players on offense and defense through Week 6, split by their listed roster position. Offensive linemen and quarterbacks are excluded from the analysis due to the static nature of their alignments.

One important element to note is that individual versatility is not a measure of quality in either direction. There are Hall of Famers and all-time greats who are both highly positional versatile (Charles Woodson playing cornerback, safety, and linebacker) and less versatile (Randy Moss who did not take many snaps at fullback). The versatility calculations only use snap counts, with no play level evaluation of success. While we do not have per-snap effectiveness on a player level, we do have it on a team level. Interestingly, skill position versatility is positively correlated with team offensive EPA per play (model via nflverse) as seen in Figure 3, whereas there is no linear correlation between defensive versatility and defensive EPA per play. This would be an even stronger trend if the Los Angeles Rams offense was closer to the productivity of prior seasons.

Returning to Figures 1 and 2, we can start to tease out the schematic links to why these specific players are highly versatile. Julian Love and Chuck Clark are both “do everything” safeties, with Love playing for the New York Giants’ Wink Martindale (known for being creative and aggressive), and Clark playing for the Baltimore Ravens’ Mike McDonald, a former staff member under Martindale. Moving to linebacker, Arizona Cardinals’ Isaiah Simmons and Miami Dolphins’ Jerome Baker are the top two, but with totally different positional distributions, with Simmons spending approximately a third of his time as a cornerback or slot cornerback, and Baker almost half the time working as an edge rusher or interior lineman.

On the offensive side of the ball, two Rams players, wide receivers Cooper Kupp and Ben Skowronek, lead the way in terms of offensive versatility, frequently lining up all over the field. Skowronek is noteworthy for the number of snaps he plays at fullback. For running backs and fullbacks, San Francisco 49ers’ Kyle Juszczyk and Baltimore Ravens’ Patrick Ricard are the most versatile, both playing for coaches/coordinators (Kyle Shanahan and Greg Roman, respectively) known for experimental approaches to the run game and offense in general. Interestingly, the top tight end group all spend slightly less than half their snaps in traditional tight end alignments, with the majority of the remaining snaps split between wide receiver and slot wide receiver.

In the next installment in the series on positional evolution, we will look at the positional trends in participation – what the distribution of common box stats are across position groups over time. For more on positional versatility, follow along on Twitter, where the team and Top-5 charts will be updated weekly.

Contributed by: Andrew Patton

The Evolution of Personnel Groupings and Usage

October 7, 2022

The recent Extra Point post “Where have all of the NFL points gone?” outlined how the 2022 NFL season has had the fewest points scored per game through Week 3 since 2010. The primary driver for this change is the severe reduction in passing efficiency. According to data provided by the nflverse team (Ben, Seb, Tan, Lee, and John) there was an approximately 180-point cumulative drop from Week 3 in 2021.

The main hypothesis for the decrease in aerial fireworks is the increasing prevalence of “two high” safety systems designed to take away the deep pass and force offenses to chip their way down the field. These systems were popularized by Vic Fangio during his time as the defensive coordinator of the Chicago Bears from 2015–18 and the head coach of the Denver Broncos from 2019–21 and his disciples have spread across the league. As a response to the increased potency and frequency of passing, teams play an increasing amount of nickel defense (five defensive backs) at the expense of base defense (four defensive backs). As seen in the figure below, the ratio of nickel to base has increased from close to even to now greater than 2.5x, with teams in nickel more than 65% of all defensive snaps through Week 3. While just calling a defense “nickel” doesn’t do justice to the complexities of NFL defenses, we can still use the label in terms of high-level strict personnel.

Teams have been able to replace a defensive lineman or linebacker with a defensive back because offensive teams are playing more “11” personnel sets (1 RB, 1 TE, 3 WR) at the expense of heavier formations — and pretty much everything else. Since 2010, the prevalence of three or more WR formations has increased from 55% of all offensive snaps to 65%. The trend is primarily due to the explosion of “11” personnel groupings as seen below. The most extreme example of this was when the Los Angeles Rams played 100% of their offensive snaps in "11” personnel in their Super Bowl LVI victory.

However, and this is the fun part, the traditional roster position listed on the roster used to determine personnel groupings does not always align with how a player is actually used. The Rams have used WR Ben Skowronek in a traditional I-form fullback, including 19 (effective) snaps in their Week 2 31-27 win against the Atlanta Falcons.

This example merely scratches the surface on the personnel trends over the last decade. We will explore this concept in upcoming posts. Our next installment will dive into league-wide trends in positional versatility on both sides of the ball.

Contributed by Andrew Patton

Where have all of the NFL points gone?

September 27, 2022

Through the first three weeks of the 2022 NFL season, the league has seen historic comebacks, two surprise undefeated teams and more tight games than ever before.

Despite the excitement, this season's games are averaging only 42.1 points per game, a 5.0 points-per-game drop over the first three weeks of the 2021 season and lower than any season since 2010.

Where did all the points go?

The following chart shows net points added by play type using two sources — nflverse and TruMedia — and comparing 2022 to the previous ten seasons. The net points chart shows the relative change in a game’s point total due to five play types — runs, passes, extra points, field goals, and penalties — using games through Week 3.

The drop in total points in 2022 can be primarily attributed to changes in the passing game. In each of the graphs, the blue line representing pass plays plummets from 2021 to 2022. By TruMedia’s net points, this season's pass plays have been less efficient than in any of the previous 10 seasons, yielding roughly 206 points fewer than the 2011-21 average (nflverse shows about 180 fewer points on pass plays).

However, despite the drop in passing game efficiency in 2022, run game efficiency has increased. While running plays typically are associated with less scoring for several reasons, (teams running the ball to drain the clock) overall net efficiency on run plays this season is approaching that of passing the ball.

Unlike the pass and run games, the overall effect of penalties, extra points and field goals in 2022 is in line with recent seasons.

Going beyond play type, what else has changed? Here are a few additional metrics we explored:

Overall pass effectiveness

- Teams are passing with relatively similar frequency to the last few seasons — 63.3% of plays are pass plays.

- Via PFF, the rate of catchable balls is 63.8% in 2022, a five-year low. Last season through Week 3, 65.8% of balls were catchable.

- The rate of dropped passes is in line with similar seasons.

- Sack rate, time to throw, and time to pressure are similar in 2022.

- Teams are combining for 462 yards passing per game — the second-lowest total since 2012 and 28 yards per game fewer than in 2021

Defensive strategy

- NFL Teams are employing coverages with different frequency in 2022, including putting less emphasis on man schemes. Rates of Cover-1 man have dropped to 19.8% from a four-year average of 26.5%. Schemes with multiple deep safeties have jumped, including Cover-2 zone (up to 13.8% usage in 2022 from a four-year average of 11.2%) and Quarters (up to 14.7% usage in 2022 from a four-year average of 11.4%).

- Defenses are running Cover-0 with no deep safeties at a slightly higher frequency of 3.7% of plays, versus four-year average of 2.7%. And they’re doing it more effectively — the average expected points added per play against Cover-0 is -0.21 in 2022, about 0.40 points per play — and 80 net points added per season — lower than the four-year average. Cover-0 is a high-risk, high-reward style of play that has been worth the risk for defenses so far in 2022.

- Defenses have blitzed on 38.5% of plays in 2022, a big jump over the average of 27.4% over the previous four seasons.

Anecdotally, teams have also lost 11 red zone fumbles through Week 3, tied for the second most since 2011. The per-play rate of fumbles near the goal line is its highest rate since 2011.

With NFL kickers better than ever before, why are kickoffs shorter?

August 23, 2022

NFL kickers and punters have slowly improved for decades, resulting in more accurate field goal kicking, lower touchback rates on punts, and rules changes that impacted both place-kicking and kickoffs.

Kickoffs have seen the most dramatic results, with touchbacks going from a 41% touchback rate in 2011 to 61% in 2020.

Despite the trend in kicker improvement, in 2021, following two consecutive years of record highs, the rate of touchbacks on kickoffs dropped to 57%. With kickers more skillful than ever before, what changed?

The stats show that NFL kickers purposefully kicked it shorter in 2021.

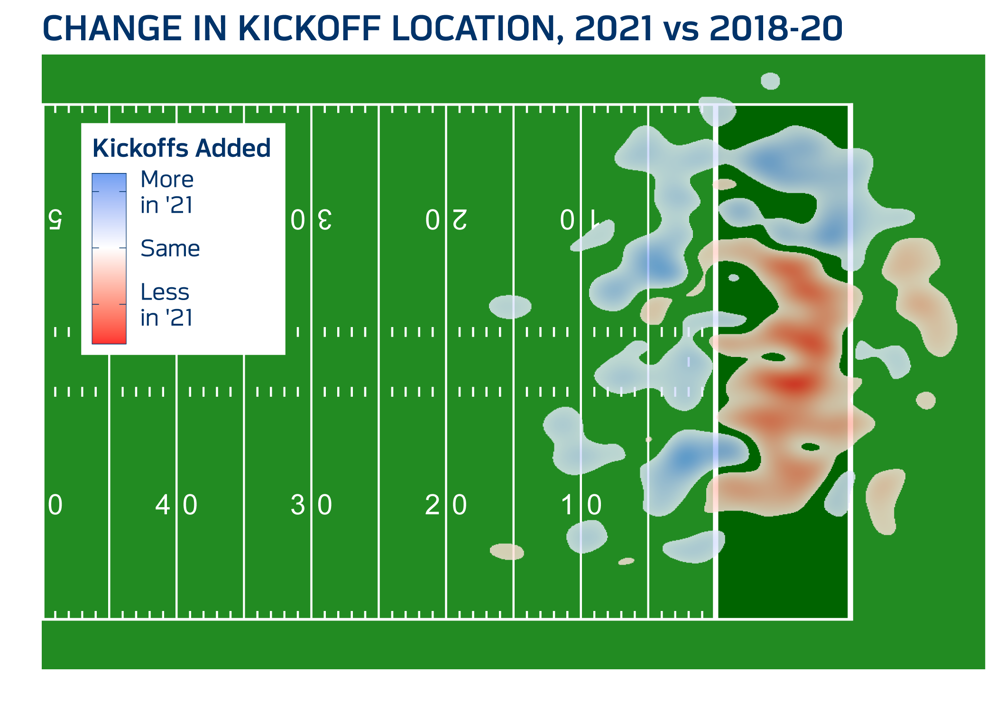

The map below compares the location of kickoff landing spots in 2021 relative to the three previous seasons (2018-20). The blue areas correspond with higher landing rates in 2021 (largely before the goal line), while red areas (largely in the end zone) reflect lower landing rates.

In 2021, 27.7% of kickoffs fell short of the end zone in comparison to 23.4% in 2020. Interestingly, the results were not consistent across the league, with some teams (or special teams coaches) moving in different directions.

Using kickers that remained on the same team in 2020 and 2021, the chart below shows year-over-year change in percent of short kickoffs. Each line represents a separate kicker. In blue, there are nine kickers (including the Houston Texans’ Ka’imi Fairbairn and the San Francisco 49ers’ Mitch Wishnowsky) whose short kickoff rate jumped by at least 10% from 2020 to 2021. In red, there’s one kicker (the Detroit Lions’ Jack Fox) who saw a corresponding decrease in short kickoff rates.

The increase in short kickoffs, with a noticeable between-kicker deviance in behavior, suggests teams are purposefully kicking short. In doing so, kickoff teams are forcing the return team to actually return the ball. So, why would they do that?

Despite the ball going a shorter distance, kickoffs landing between the 1-5 yard line result in worse field position for the receiving team (average field position is the 24-yard line) than kickoffs landing inside the first five yards of the end zone (average field position is the 24.7-yard line). In turn, the slight field position benefit forces teams to return the ball which is the only way of potentially forcing a turnover.

The kickoff is one example of several rules changes that have led to different on-field outcomes – some intended, some unintended. As the 2022 season kicks off, we’ll be tracking if the trend in short kickoffs continues.

Using data and analytics to evaluate the 2022 club proposals on overtime in the postseason

March 30, 2022

During the 2022 NFL Annual Meeting, NFL clubs voted to implement a new format for overtime rules in the postseason which guarantees each team a possession. This change is an amendment of a club proposal from the Indianapolis Colts and Philadelphia Eagles.

To supplement conversations on overtime, the NFL’s analytics team looked at a variety of metrics to better understand the history and direction of potential formats. Below are a few of the key takeaways.

Equity

Since overtime was implemented in 1974, the NFL has not changed its view that each team should have a fair shot at winning. However, over the last decade, a few subtle changes have made it easier for the team that receives the ball at the start of overtime.

In 2016, the NFL moved the touchback line on kickoffs from the 20- to the 25-yard line. This not only made touchdowns on the opening drives more likely, but also pushed the kickoff team farther back if it were to make a stop. Second, offenses are scoring more. This year’s total of 46.0 points per game was the fourth highest in league history. Lastly, teams are now more aggressive on fourth down than they have ever been. In 2021, teams went for it more on fourth-and-short than in any other year in the modern NFL era.

As a result of these changes, the importance of winning the coin toss and receiving the ball has also trended higher. Using the regular season overtime rules, our best Win-Loss-Tie estimate for a team receiving the ball is 54-39-7. That’s around 15% more likely that the team receiving the ball will win than it will lose. Although the estimate is an average across all teams, for teams with top offensive units, receiving the ball is even more beneficial. For example, in the 2021 Divisional Round game between the Buffalo Bills and Kansas City Chiefs, we estimate that the benefit of winning the coin toss was a swing of 25 win percentage points.

What does a guaranteed second possession do?

It secures a benefit – known as the second mover advantage – for the team that starts overtime by kicking off. Teams kicking off to start overtime will always know what is needed to either extend overtime or win the game when they get the ball back.

While the second mover advantage swings the coin toss benefit closer to 50-50, one key advantage remains for the team that receives the ball first. If the opening two drives of overtime end tied, the team that received the ball first gets the ball again in a sudden-death setting. For example, from 2017-21, the team receiving the ball first in overtime averaged 1.6 possessions per overtime session, compared to 1.1 for the team kicking off. As a result, teams receiving the ball to begin overtime won more games after their first possession than on their opening possession.

In a format where both teams have at least one possession, we expect the benefit of winning the coin toss to drop by more than half. In some postseason overtime games, teams may even want to kick off, though that decision could be dependent on team strength and weather conditions.

Entertainment

The last two games of the Kansas City Chiefs’ 2021 postseason, versus the Buffalo Bills and Cincinnati Bengals, had the Chiefs winning the overtime coin toss. Although, there was one key difference – the game against the Bills ended on the first possession, while the game against the Bengals had two possessions. To compare these two games, we used minute-by-minute Nielsen television ratings to highlight how during close games, TV ratings rise and peak at the end of a game, and once the game concludes, ratings drop off. From this data, we projected that an extra possession during the Chiefs versus Bills game would have likely generated at least five minutes of 50+ million viewers.

Long games

One of the concerns of adding additional possessions to overtime is the potential of games dragging on.

However, in overtime games where both teams open with a touchdown, a third possession is not expected to occur. In this setting, the team scoring a second touchdown is likely to face two options - a game deciding two-point conversion, or an extra-point attempt to force sudden death. We reached out to eight analytics staffers who advise head coaches over headsets on gameday and gave them this exact scenario. All eight confirmed that they would typically tell their coach to go for two. That type of aggressiveness could result in a game-deciding two-point conversion to end overtimes that begin with two touchdowns.

The rate of overtime occurring in NFL games, both as a percentage of games that go to overtime (5.5%) and of overall game time spent in overtime (0.5%), is lower than the NBA, NHL, and MLB.

Game quality

NFL overtimes also feature high-quality play. Compared to regulation, overtime plays have a lower rate of penalties, penalty yards, and missed calls from officials. In terms of health and safety, rates of missed-timed injuries and concussions drop by roughly a third in overtime. As the NFL considered formats that would only add time to overtime, ensuring a high standard of play was paramount.

Postseason

Teams receiving the ball in overtime in the modified sudden-death format (2010-21) were 10-2 (win percentage of 0.8%), driven by seven touchdowns on the opening drive. Although a small sample, the high number was often cited over the last month as the reason for driving change.

For more information about the updated overtime rules, visit the NFL Overtime Rules page.

Does Home Town Factor in Free Agency Decisions?

March 17, 2022

The 2022 NFL free agency window officially opened on March 16. Many players who currently are not under contract are weighing their options to decide where they should sign. There are many factors that go into a player's decision, including contract terms, coaching staffs and the potential success of a new team. Perhaps a less-frequently discussed factor: the proximity of each team to where a player grew up.

To assess whether or not players are more likely to sign near where they grew up, we looked at all free agent signings during the opening weeks of free agency from 2016 to 2021. This time period corresponds to when players tend to have the largest number of teams competing for their services. Of the 266 free agents with available birth location data, 13 (4.8%) signed with a team located close to the city in which they were born.

While that doesn’t sound like a high rate, it is substantially higher than what we’d expect due to chance. To estimate chance, we simulated free agency 10,000 times for each season by shuffling the locations where each free agent signed and calculating the distance between that city and the player’s birth city. We then compared the actual distribution to what was observed. The blue density curve below represents the 10,000 simulations, and the red line represents the observed percentage.

Overall, the observed rate with which players choose to play within 50 miles of home is larger than more than 99.9% of the simulations. Additionally, the relative rate of players signing closer to home is about 2.3 times higher than the average simulated percentage.

How NFL teams use the game clock – and what it says about late-game strategy

December 16, 2021

In a Week 14 matchup with the Cleveland Browns, the Baltimore Ravens scored a touchdown to cut Cleveland’s lead to nine. Ravens head coach John Harbaugh decided to attempt a two-point conversion to try and trim the lead to seven. The Ravens failed to convert and eventually lost 24-22.

Harbaugh offered an explanation for his aggressive end-of-game strategy, but not everyone supported his reasoning to go for two.

“If you’re down two scores, the other team will change their play calling, and how they direct the game,” said a skeptical Phil Simms on CBS Sports’ “Inside the NFL.” “We don’t put that into the analytics.”

To assess if the play-calling aspect of Simms’ argument was accurate, the NFL Football Operations team looked at the run vs pass rates on all first down plays from 2006-21 (using plays before a team reaches field goal range), and split by game minute and score differential in the graph below.

The blue tiles correspond to game settings based on time and score where teams run more often. The red tiles represent situations in which teams tend to pass. The yellow tiles reflect situations that call for a more balanced strategy.

There are two points in games where the strategies change based on the game situation. The first change occurs during the final two minutes of the first half. Offenses pass more, throwing the ball on around 75% of first-down plays. The second change in strategy comes near the end of the third quarter, when (as is shown in this chart) strategy starts to diverge based on both time remaining and score. Teams trailing later in games tend to throw more passes, while teams leading run more. Late in games, the difference in strategy is even more dramatic: teams trailing pass the ball close to 90% of the time on first downs; and teams with the lead run the ball at a similar rate.

To better understand the setting in the Ravens-Browns game, we focus our chart only on teams in two-possession games in the fourth quarter.

We’ve added dotted lines to show games separated by one score (1-8 points) and two scores (9 or more points).

Changes in strategy appear concentrated at each of the four horizontal lines in the graph.

As Simms suggests, teams leading by two scores run the ball 10% more often (75% vs 65%) than teams up by only one score. Teams trailing by two scores are much more likely to pass (80% vs 68%) than if they’re trailing by one score. The data shows a line of demarcation where strategy changes depending on if the score is separated by one score versus two.

But bigger leads don’t just change the probability of whether an offense calls a running play versus a passing play. There’s also an inverse link between the size of a lead and offensive success.

When compared to teams trailing by one score, defenses trailing by two scores have an easier time coming up with a stop. They give up fewer average first downs (1.1 versus 1.3), force more three-and-outs (45% versus 36%), and hold offenses to shorter drives (19.9 average net yards versus 24.8). All of that also takes less time off the clock (2:22 average time of possession versus 2:36).

Therefore, in the scenario Simms identifies that the Ravens faced, there are multiple data points that support more teams going for two. If you miss and trail by nine points, you're likely to get the ball back sooner.

Which NFL teams mix up defensive coverages the most week-to-week

December 2, 2021

Prior to joining the Los Angeles Chargers as head coach, Brandon Staley’s defensive scheme with the Los Angeles Rams was lauded as adaptable, aggressive, and accustomed to diverse coverage schemes.

There are several reasons why a coach may mix up schemes. Among them, flexibility in scheme allows teams to surprise opponents with matchups they have not prepared for. In 2020, Staley’s Rams defense stood out for having the most unique schemes on its way to leading the NFL by allowing the fewest yards per game.

More than halfway through the 2021 season — his first as head coach — data collected confirm that Staley’s scheme has picked up right where it left off.

Using data from PFF, the chart below shows weekly distributions of coverage schemes. Teams are organized from least consistent (top left, Los Angeles Chargers) to most consistent (bottom right, New Orleans Saints), where consistency is defined by week-to-week fluctuations in coverage.

As the model of inconsistency, the Chargers ran Cover 1 Man on 70% of Week 3 plays against the Kansas City Chiefs, only to run the same coverage just 15% of the time during a Week 4 matchup against the Las Vegas Raiders.

Teams that are more consistent from week-to-week tend to stick to the same script. For example, the Saints ran a Cover 1 Man scheme between 16-39% of the time in each of their games.

In addition to weekly shifts in strategies, these anecdotes stick out from the chart above:

- Cover 0 Man is one of the riskiest strategies to deploy, as no safeties are left to help on deep routes. So far during the 2021 season, teams have run Cover 0 Man in different ways. The Miami Dolphins ran Cover 0 Man in each of its first 12 games, including 24 times against the Baltimore Ravens in Week 10. The Las Vegas Raiders have run Cover 0 Man only five plays all season.

- Eight games this season have featured a team that ran the same coverage scheme on at least 70% of defensive snaps. The Raiders’ Cover 3 Zone accounts for six of those eight games. Against the Philadelphia Eagles in Week 7, the Raiders ran Cover 3 Zone on 95% of defensive snaps.

- The New England Patriots ran a zone-based coverage scheme on about 40% of snaps from Weeks 1-6. From Week 7 onwards, they have been in zone coverage on about 70% of defensive snaps.

Coverage schemes are also relevant for measuring what defensive coordinators think about their opponent’s offenses. Some quarterbacks may be more difficult to prepare for and could force opponents to try new strategies for defending the pass.

The chart below shows what coverages each team’s offense faces.

Second-year Eagles quarterback Jalen Hurts has faced unique coverages. Teams have deployed both zone heavy (Weeks 9 and 10) and man heavy (Weeks 7, 11, and 12) approaches to slowing down the Eagles offense.

The Eagles offense has also faced the second-most Cover 0 Man defenses (65 snaps, behind the Baltimore Ravens’ 87 snaps) with Hurts and Ravens quarterback Lamar Jackson among the NFL’s most mobile signal-callers. In comparison, the Chiefs and quarterback Patrick Mahomes, a traditional pocket passer, have only seen Cover 0 Man on seven snaps, fewest in the league.

What it takes to evaluate the NFL’s future stars

November 11, 2021

As part of the scouting and evaluation process, future NFL players will often participate in a series of position-level drills overseen by team scouts and other league personnel. The NFL’s Scouting Combine is one place where these drills occur, along with club pro days and other league events, including the NFL’s International Combine and HBCU Combine.

At the 2021 International Combine held at London’s Tottenham Hotspur stadium, NFL Football Operations staff experimented with new drills designed to more effectively align with NFL game player movement and mechanics during NFL games. For instance, an example of this drill modification would be drills for offensive linemen and linebackers that include 45-degree angle movements, actions that were previously uncaptured for those two position groups at the Scouting Combine. As a basis for capturing player movement, the league used an algorithm from a 2019 winning Big Data Bowl paper, as outlined here.

Below are several videos showcasing the newly implemented drills.

New Offensive Line Drill: 45-Degree Sprint

Players start with one knee down, then sprint at a 45-degree angle past a cone 10 yards away. This drill is replicated on each side.

New Offensive Line Drill: Pull Drill with 45-Degree Finish

Players start with one knee down, then pull and turn upfield through a cone 10 yards away. This drill is replicated on each side.

New Defensive Line Drill: Hurdle/Sprint/Cut on Demand

Players start with one knee down, then shuffle laterally over three bags, sprint forward, and finish by sprinting back through the starting cone.

New Linebacker Drill: Drop/Shuffle/Sprint

Players start with one knee down, then mimic a pass play by dropping back at a 45-degree angle, shuffling five yards, and finishing by catching a ball and sprinting through a cone.

New Wide Receiver Route: Crossing Pattern

Players start by running a crossing pattern before catching a ball and sprinting downfield.

In NFL games, crossing patterns represent 11% of all receiver routes, but were previously not tested at the combine. In London, these routes were tested at a depth of 18 yards.

How do NFL coaches use their timeouts?

November 10, 2021

NFL teams receive three timeouts each half. Timeouts can be used strategically to manage the clock or to avoid a penalty or unwelcome formation. Given the value of timeouts during end-of-game scenarios — ESPN Sports Data Scientist Brian Burke estimated that each second half timeout is worth about 3% in win probability — coaches are generally reluctant to call a timeout until the final minutes of each half.

To compare how current NFL coaches use their timeouts, we began by categorizing each timeout into one of the following categories:

Timeouts worth saving

These timeouts typically are called later in a half to conserve time on the game clock.

Time Saving, Offense: Called when a team is on offense, these timeouts typically come at the end of a half, and are called to stop the clock immediately after a play ends in order to conserve time on the game clock to reset ahead of the next play.

Time Saving, Defense: Called when a team is on defense, these timeouts typically come at the end of a half, and are called to stop the clock immediately after a play ends in order to try to get the ball back or conserve time on the game clock.

Timeouts coaches would like to have back

These timeouts typically are called earlier in a half when something doesn’t go as planned.

Unnecessary, Offense: Called when an offense is trying to avoid a delay of game or an uncertain play call.

Unnecessary, Defense: Called when a defense is dealing with substitution issues or when a coach is not confident in a defensive set.

Lost Challenges: Teams are docked a timeout after each failed instant replay challenge initiated by the head coach.

Other timeouts

Less than 5% of timeouts are called for other reasons, including timeouts for injured players with less than two minutes in a half, timeouts called right before the end of a half with a stopped clock, or timeouts meant to “ice the kicker.”

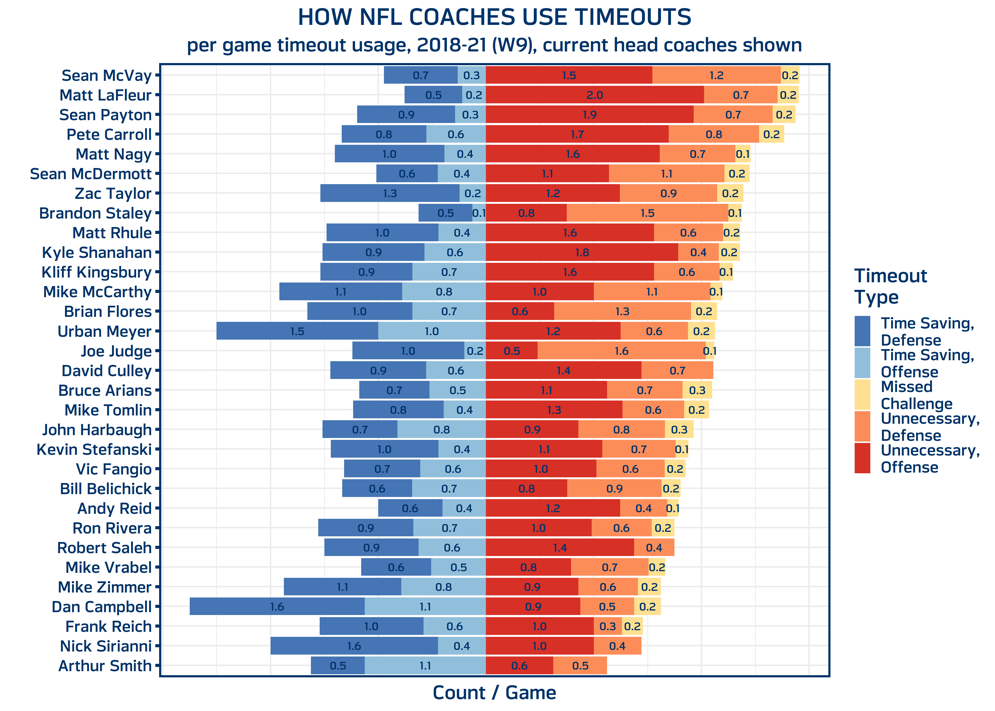

The following chart shows the first two categories of timeouts, plotted for each of the 31 current non-interim head coaches on a per-game basis from 2018–21 (Week 9).

The plot is ordered in terms of number of unnecessary timeouts (shown in red, orange, and yellow).

Current Rams head coach, Sean McVay, leads all coaches with 2.9 unnecessary timeouts per game (1.5 on offense, 1.2 on defense, and 0.2 in missed challenges), with Packers coach Matt LaFleur (2.9) and Saints coach Sean Payton (2.8) right behind. First-year head coaches Arthur Smith of the Falcons (1.1 per game) and Nick Sirianni of the Eagles (1.4) are most judicious with their timeouts.

First-year coaches Dan Campbell of the Lions (2.7 time saving timeouts per game) and Urban Meyer of the Jaguars (2.5) use the most time-saving timeouts, though much of that is likely driven by each team’s circumstance (the Lions are 0-8 and the Jaguars are 2-6).

Knowing each coach’s background gives additional context regarding offensive versus defensive timeout usage. The three head coaches with the highest total of unnecessary offensive timeouts are all former offensive coordinators — LaFleur, Payton, and 49ers coach Kyle Shanahan. The three coaches with the highest total of unnecessary defensive timeouts include former special-teams coordinator (Joe Judge of the Giants, 1.6 per game) and former defensive coordinators (Brandon Staley of the Chargers, 1.4 per game, and Brian Flores of the Dolphins, 1.3 per game).

Crowd noise may also play a role. If we compare by season and team — both home and away — we see that the 2020 season without fans featured 0.39 fewer unnecessary offensive challenges per game, relative to 2018, 2019, and 2021. And when there are fans, visiting teams call 0.19 more unnecessary offensive timeouts per game than home teams, a difference that is consistent across seasons.

Can Next Gen Stats Help Predict Pass Plays?

October 21, 2021

NFL officials prepare for games each week similarly to how NFL teams game plan for weekly opponents. In this instance, officials study team matchups for games they are assigned to, along with league-wide tendencies.

An aspect of a play that can change officials' responsibilities is whether the play is a designed run or drop-back pass. Penalties such as defensive holding, pass interference and roughing the passer are only typically called when the quarterback drops back to pass. Pre-snap tendencies can also aid officials when it comes to their responsibilities on a given play.

As a way of assessing league-wide offensive tendencies, the plot below uses the NFL’s Next Gen Stats locational data to visualize pass rates based on running back alignment. Only plays with the quarterback in shotgun formation with exactly one running back are used. Additionally, only locations (0.5 x 0.5 square yards) with a minimum sample of 10 plays are provided.

When the running back is aligned alongside the quarterback, the vertical and horizontal position of the ball carrier is a strong signal of the play type. For example, when the running back is two yards behind the quarterback, teams only pass the ball around 20% of the time (shown in the red cells). Alternatively, when the running back and quarterback are at equal depths (70% pass rate), or if the running back is in front of the quarterback (85% pass rate), the likelihood of a pass play is higher.

Teams lining up in the pistol set, where the ball carrier lines up behind the quarterback, tend to run the ball as well, though that rate increases when the ball carrier is closer to the quarterback.

Location-based passing tendencies can vary from team to team. For example, when analyzing plays with a single running back located 5 to 7 yards behind the line of scrimmage, the league average pass rate is 44%. But in 238 plays in those formations, the Dallas Cowboys passed the ball 67% of the time, while the Houston Texans only passed it 25% of the time in 265 total plays.

What record will be good enough to make this year’s NFL playoffs?

September 29, 2021

With the NFL’s recent expansions to a 14-team playoff in the 2020 season and a 17-game schedule this season, the calculus for identifying what win-loss records may be needed to make the playoffs may have changed, too.

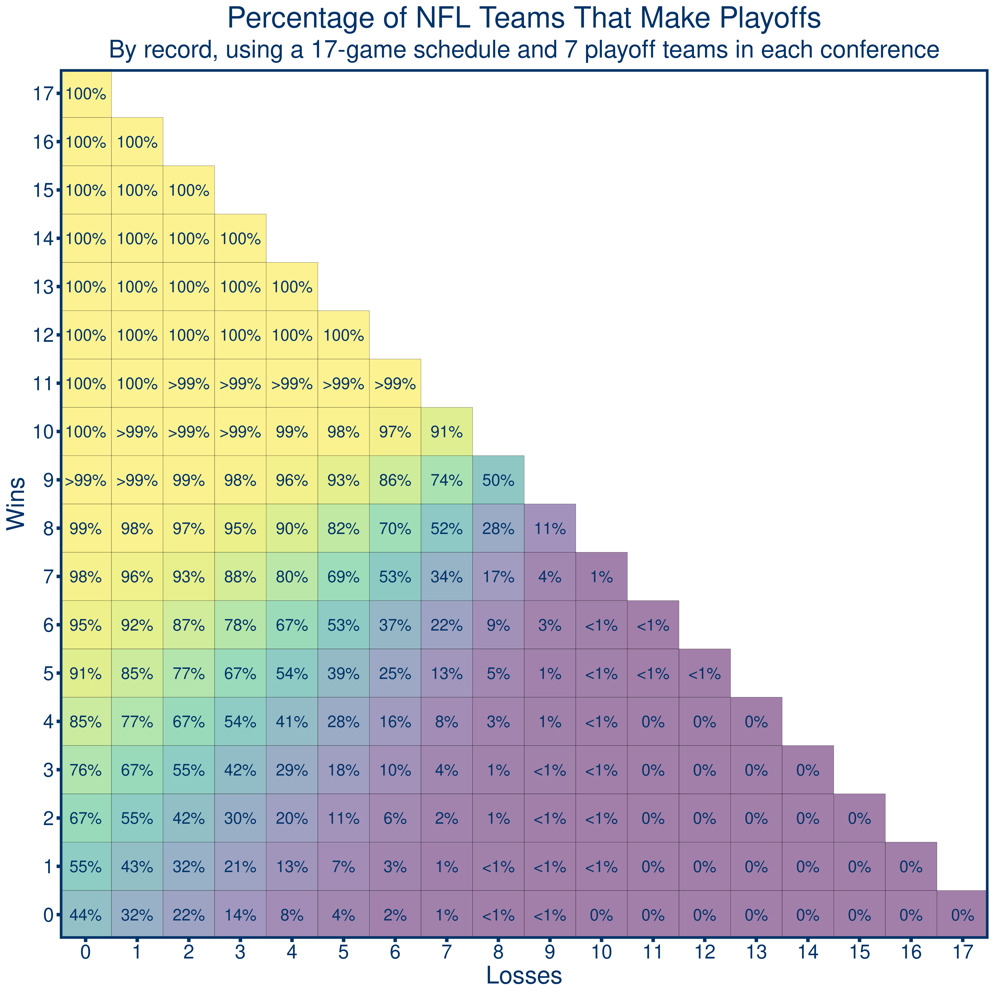

To better understand the playoff implications of each win or loss, we used the nflSeedR package in the R Statistical Software to simulate 10,000 17-game NFL seasons based on historical estimates of team strength. Below, we visualize the probabilities for playoff, division, and top-seed hopefuls across the league.

The first chart shows the percentage of NFL teams that can expect to make the playoffs at each record (credit to FiveThirtyEight for the idea).

In the graph, teams that start 3-0 can expect to make the postseason 76% of the time. The odds drop with each loss; a team that starts 2-1 sees its chances drop to 55%, a 1-2 team drops to 32%, and a winless start means a team can only expect to make the postseason 14% of the time. Week 4 can provide additional clarity — if a 3-0 team wins to go 4-0, their expected chances of qualifying for the postseason jump to 85%. If that team falls to 3-1, the likelihood of earning a playoff spot drops to 67%.

Additionally, the chart shows that extreme circumstances are still possible. For example, there’s about a 1% chance that

- A team finishing with a 7-10 record will make the playoffs

- A team that starts 8-0 will miss the playoffs

- A team that starts 0-7 will make the playoffs

Earning a playoff berth is not the only goal. Teams that win their division or finish as the conference’s top seed gain the advantage of playing playoff games at home. Here are similar charts showing the percentage of teams that win divisions and finish as top seeds.

Teams that start 3-0 have about a 51% chance of winning a division title and a 20% chance of earning the No. 1 seed. For 0-3 teams, those chances plummet to a 6% chance of winning their division and less than a 1% chance of earning their conference's No. 1 seed.

Assessing the Change in Draft Pick Value Across Positions

April 26, 2021

The 2021 NFL Draft is scheduled to kick off from April 29 to May 1 in Cleveland. Most of the pre-draft conversation has been centered around the quarterback position, with some mock drafts predicting four quarterbacks being taken with the first four picks.

If the pre-draft predictions hold true, how common is it for top draft picks to be used on the quarterback position?

Using a Draft Value Curve table, NFL Football Operations analyzed the overall draft capital devoted to each position in each NFL Draft from 1970 to 2020. The table, like others before it, aims to assess the relative value of each draft pick based on the performance of players chosen in each draft spot.

The first chart uses the percentage of draft value assigned to quarterback (blue), running back (green), and defensive back (red) positions since 1970.

During this time, the percentage of draft capital used on quarterbacks has increased. While they are only one of the 22 players on the field, they accounted for roughly 8% of total draft capital in the 2020 draft, consistent with the uptick that began roughly two decades ago.

With the passing game taking on greater importance, valuation of defensive backs has also increased. In five of the last six seasons, for example, defensive back ranked first among all positions as far as draft capital percentage — in the mid-1970s, it ranked as low as fifth.

Running back has seen the largest decline in draft capital over this period. In 1970, approximately 15% of draft capital was used on running backs — the third highest for any position. However, by 2020, the position dropped to seventh, falling behind quarterbacks and losing nearly 8% of draft capital.

The second chart shows the average draft capital allocated to each position group.

What data and analytics told us about 2021 Offseason NFL rules proposals

April 2, 2021

The 2021 NFL Playing Rule Proposals covered a variety of topics, including uniform numbers, overtime, and the instant replay review process. In mid-April, team owners will review and vote on each proposal. See how the NFL modifies or adopts new rules.

In March, the Football Operations Data and Analytics group provided the league’s Competition Committee with evidence to help them better understand several Playing Rules Proposals. Here are two examples.

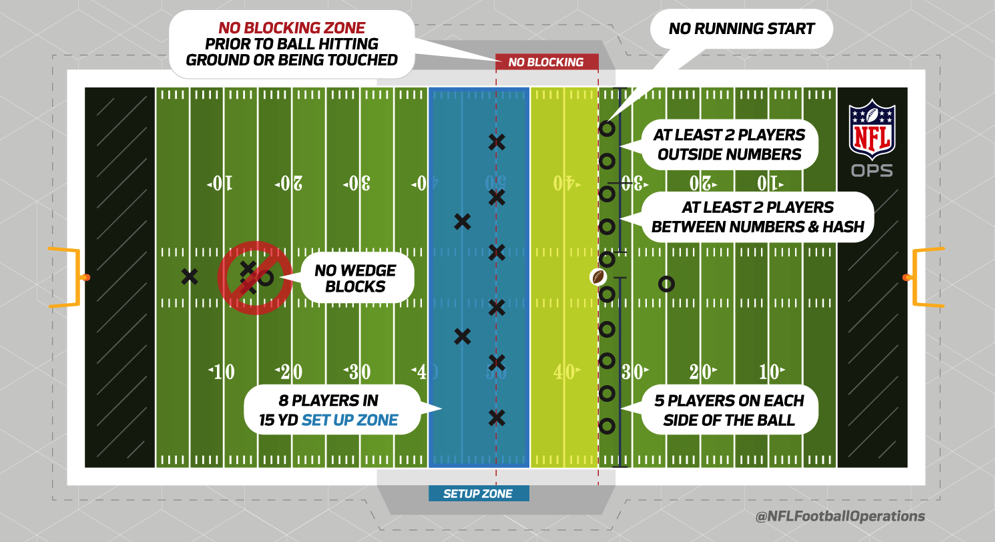

Proposal Number 2: By Competition Committee; to amend Rule 6, Section 1, Article 3, for one year only, to establish a maximum number of players in the setup zone.

Playing Rule Proposal Number 2, proposed by the NFL’s Competition Committee, would change the rules for formations on kickoffs. Currently, at least eight players — but as many as 11 — are allowed in the setup zone, a 15-yard long rectangular box that begins 10 yards from where the ball is being kicked off (see the 2018 kickoff rules proposal). The Competition Committee, with the support of NFL special teams coaches, proposed capping the number of players allowed in the setup zone at nine.

The data group used the NFL’s Next Gen Stats to identify if changing this rule could help increase the chances for a kicking team to recover an onside kick.

This table shows the frequency with which receiving teams put additional players in the setup zone, both when expecting an onside kick attempt and when not.

|

NUMBER OF PLAYERS IN THE SETUP ZONE, 2018-20 |

||||

|

8 |

9 |

10 |

11 |

|

|

Expected Onside |

0% |

0% |

87% |

13% |

|

Unexpected Onside |

98% |

<1% |

1% |

0% |

On every expected onside kick attempt from 2018-20, the receiving team loaded the setup zone with at least 10 players, and 13% of the time teams put 11 players in the zone. Alternatively, on 98% of kicks where an onside attempt was unexpected, receiving teams lined up the minimum of eight players in the setup zone.

Given this evidence, the league is testing a rule change to determine if limiting the number of players in the setup zone to nine may lead to new onside kick strategies and formations, and in turn, could lead to more recoveries.

By Baltimore and Philadelphia; to amend Rule 16, Section 1, to change the options available to the winner of an overtime coin toss and create a true sudden-death format.

Playing rule proposal Number 8, proposed by Baltimore and Philadelphia, would change NFL overtime to a “spot and choose” format. In this proposal, overtime would return to a sudden-death format (first score wins) and the starting location for the offensive team’s line of scrimmage would be determined by the coin toss.

The winner of the overtime coin toss would determine if they want to be the spot team or the choose team. The spot team first determines where the ball will be spotted, then the choose team selects whether to start on offense or defense.

The data team looked at the rate with which offensive teams scored first in first-half game situations based on the starting line of scrimmage on which a drive began. As shown in the chart below, the “break-even” point — the spot where both the possession and defensive teams are equally likely to score next — is the possession team’s own 13-yard line.

Of course, other game conditions — weather, team strengths, and how accurate a team’s kicker is — would factor into team decisions under this overtime format. Overall, though, we'd expect most spot teams to choose near the 13-yard line.

What does the NFL’s home-field advantage look like in 2020?

January 5, 2021

The 2020 regular season has seen NFL games played in empty stadiums, or in front of significantly reduced crowds. The lack of home fans may be contributing to an uncharacteristically low 127-125-1 (excluding three neutral site home games for San Francisco) record for home teams.

One group assuredly paying attention: sports bettors. Professional bettors and the sportsbooks that set lines are likely picking up on changes to the home advantage—no matter how small.

How have betting markets changed their perception of home advantage in 2020?

The plot below tracks betting market perception of the home-field advantage over the last decade.

The chart shows density curves corresponding to home-field advantage estimates from each season. Statistical models based on betting market data and inspired by this paper were used to determine home advantage estimates. These models take into account team strength, travel, and rest, in addition to home advantage.

Home field advantage had been slowly decreasing each season since 2006. However, 2020 has seen the biggest season-to-season drop over that time, dropping more than a full point from 2019. And the 1.30 point spread on average means home-field advantage is now worth less than half of what it was in 2006 (3.30 points).

We also checked whether the typical advantage provided to home teams has been constant throughout the 2020 season. Interestingly, the home advantage appeared to be higher in Weeks 1-7 (an average of 1.8 points) when compared to Weeks 8-14 (an average of 0.9 points). Perhaps, given results on the field, betting markets have adjusted.

Analyzing Defensive Pass Interference Fouls in the NFL and NCAA

November 20, 2020

Defensive pass interference (DPI) is one of the most impactful penalties in the NFL. With the way it is enforced, it is often suggested by fans and media alike that the rule should be modeled similarly to the NCAA. In the NFL, DPI is a spot foul, yielding an automatic first down to the team in possession. In NCAA football, the rule is slightly different — DPI is still a spot foul, but the maximum penalty is 15 yards.

How does DPI compare in the NFL and NCAA? NFL Football Operations breaks down three graphs that compare the two levels of football and provide further insights into the penalty.

Here’s the rate of DPI fouls per 100 pass attempts over the last several seasons.

Each season, there are more DPI calls per pass play between NCAA Power Five conference teams than in the NFL. One of the possible explanations is the increased weight of punishment is enough for NFL defenders to commit fewer fouls. For example, on deep pass plays, college defenders could aggressively prevent a catch to give up a smaller offensive gain than they would on a completed pass, even if DPI is called.

Next, here’s the percentage of overall penalties in a season that are DPI fouls.

Looking at all fouls committed in an NFL and NCAA season, a greater percentage of NCAA calls are DPIs, compared to the NFL.

Finally, below are penalty yards that result from DPI fouls.

The chart shows the variability of DPI penalty yards in the NFL compared to the NCAA with slightly more penalty yards at shorter distances in the NFL. Alternatively, 47.1% of NFL DPIs are 15 yards or more, while 56.1% of NCAA DPIs would be 15 yards or more, but they are capped at 15 yards.

Although the NFL’s lack of cap on penalty yards for DPI fouls increases the possible yardage impact, it could also decrease the frequency of these penalties.

Comparing Kickers Across the League on Accuracy Between the Uprights

October 22, 2020

Due to Justin Tucker having one of the strongest and most accurate legs in the NFL, some experts suggest that he may be the best kicker in league history.

Tucker’s kicks are so accurate that they sail directly through the uprights more often than any other NFL kicker, flying directly through over the center of the crossbar.

The chart below has kickers who led each NFL team in kick attempts since the start of the 2018 regular season and uses Next Gen Stats football tracking data to show each kicker's makes or misses on field goals and extra points. The data identifies where, relative to the uprights, each kick crossed the end line.